Navigating The Quagmire Of Student Loans: A Comprehensive Analysis

Interest Rates: The Silent Accumulator

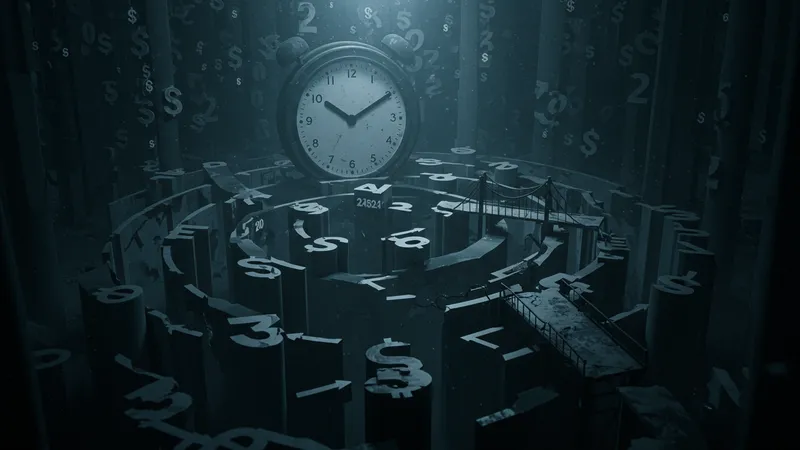

Interest rates may seem negligible upfront, but they quietly accumulate over time, turning manageable loans into financial nightmares. Fixed rates guarantee consistency, yet variable rates can skyrocket unexpectedly, often shocking borrowers unprepared for the hike. The real issue lies in understanding these interest nuances. Are you focusing on numbers over your future financial well-being?

For some, refinancing offers a refuge, seemingly providing a lower rate or better terms. However, it’s crucial to calculate what you’ll end up paying over the life of a loan before opting in. Many end up paying more due to simple miscalculations, and refinancing would do little to mitigate unforeseen changes. But what does this mean for potential borrowers?

The government offers various repayment plans suited to different financial situations, but they rarely address the roots of the problem. With options like income-driven repayment plans capping payments at a percentage of income, it appears like a win at first. Yet, ballooning interest could eventually offset these benefits and leave people wondering what their degrees are truly worth. So, what’s next could be surprising…

Even though scholarships and financial aid are accessible, they are not foolproof solutions. Many students, keen to avoid escalating debts, rely on these aids, but the fierce competition limits their reach. After all, thousands aim for the same relief. They might provide a head start, but they aren’t the alchemist’s stone we wish for. Are there other solutions waiting to be discovered?