Bankruptcy Law Explained: Types, Processes, And Legal Rights

Types of Bankruptcy in the Legal Framework

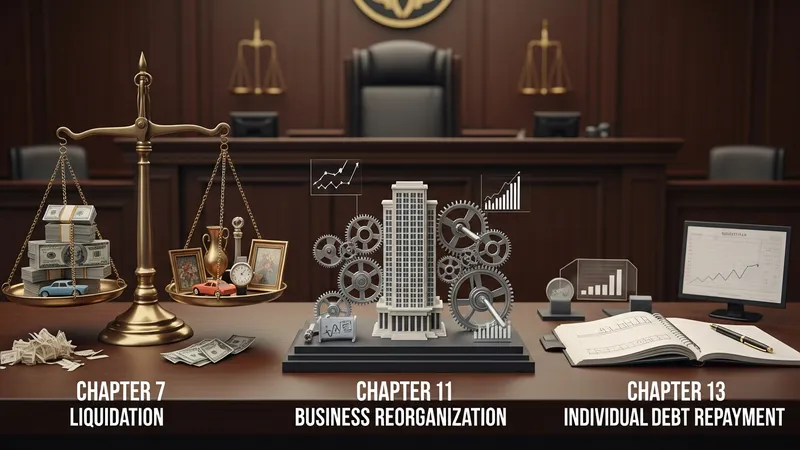

Bankruptcy laws generally categorize filings by the nature and context of the debtor’s financial difficulties. Chapter 7, Chapter 11, and Chapter 13 are commonly referenced forms, each designed for distinct circumstances. Chapter 7 focuses on liquidation, requiring non-exempt assets to be sold with proceeds distributed among creditors. Chapter 11 permits reorganization for businesses seeking to continue operations and negotiate new terms with lenders. Chapter 13, meanwhile, enables individuals with steady income to repay debts under court supervision, often over a specified period. These structures illustrate the different approaches legal systems take in managing insolvency cases.

Eligibility for each bankruptcy type typically depends on various legal and financial criteria. For instance, Chapter 7 may require the debtor to pass a means test, evaluating income relative to living costs and existing debt. Chapter 11 is generally employed by corporations, partnerships, or individuals with significant, complex debts. Chapter 13 sets requirements regarding debt limits and proof of reliable income. By setting these parameters, the law aims to guide filers toward the most appropriate pathway and to ensure that the relief provided matches both the debtor’s and creditors’ interests.

The procedural differences between bankruptcy types also influence outcomes and obligations. While Chapter 7 can often result in the expedient discharge of qualifying debts following asset liquidation, Chapter 11 and 13 cases may be more prolonged due to negotiation and restructuring phases. These distinctions affect the scope of debtor protections, creditor returns, and the timeline for legal resolution. Understanding the implications and requirements of each type is foundational when navigating bankruptcy law’s application in practice.

Choosing between bankruptcy types is impacted by the nature of debts involved, the structure of income and assets, and the long-term objectives of the parties. For instance, businesses aiming to preserve functions and relationships typically consider Chapter 11, while individual debtors with substantial secured debts may contemplate Chapter 13. Legal counsel and court oversight ensure that the chosen route complies with legislation and maintains equilibrium between the rights of all involved. The next section explores the main procedures within bankruptcy law.